Iconomi recently introduced a new feature on their investment platform allowing anyone to run their own crypto fund.

The alternative is to select from one of the many existing, professionally-run funds such as the BLX fund, but… if you reckon you know more about the market, the most promising cryptos and are prepared to update or re-balance (especially at this stage), then why not go for it? It makes sense if you’re watching the market all the time.

The Iconomi site itself – and mobile app – are both crisp, clear and well-designed.

For those registered already on the site, it takes less than 5 minutes. You’ll need to set your management fee (0%-10%) and can invite private people via email, although this isn’t essential. Most funds are normally around 2% fee but it should depend on how active you’ll be. (Make sure you choose the correct name to begin with, as this can’t be changed.)

Management itself is simple and easy via the dashboard, and re-balancing involves simply entering new percentages for each project to make up 100 (of course).

If you wish to go fully public with your fund then you can contact the Iconomi team, but it’s probably a good idea to on-board a select few and prove you can generate some returns first. Timing is everything, and selecting the right projects, of which there are a good range, including most of the major ones all included.

Your friends or family can contribute funds and they can buy/sell at any time.

Why?

- It’s a great way to easily invest in crypto without worrying about wallets etc.

- You can buy and sell into funds via Euro/USD or Bitcoin or Eth (or the Iconomi token ICN) at anytime (min. 10 euro withdrawals).

- You can earn a little extra via the management fee and manage with ease.

- You can use the site algorithms to get the best prices.

- You can track the fund clearly and easily using the Iconomi site or decent mobile app.

- It’s free.

Why not?

The main disadvantages in investing like this is that you’re entrusting the Iconomi site to safely hold your investments. Also, by not hodling platform tokens like ETH, EOS etc. in their intended personal app wallets then you may miss out on automatic airdrops of dapp token projects, the option of experimenting and interacting with dapps themselves plus other staking, voting or gas reward benefits. These days you can also gain passive income via interest, or margin loan interest on many projects at other sites.

However, for selected projects or young networks with potential growth, investing and rebalancing quickly on behalf of others, without having to individually trade, is a big plus.

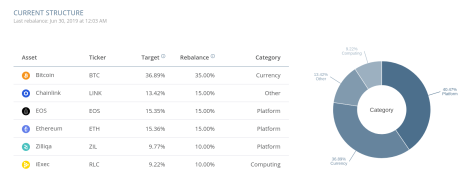

Ade’s Crypto Press Fund

I started my own fund on 27th June 2019 with 200 euros (minimum buy-in is 100 euros depending on structure).

I’ve started with a small selection at this time, and you can search this blog for more information on these projects. I invested just as Chainlink was climbing and I’ve since rebalanced once, to get a feel for it.

You can contact me here if you’re interested buying in (to request email invite), where any updates I make to the structure will be updated on this blog. This may also include moments where I recommend selling out into fiat currency, on the site, until market is ready to swing up.

Longer-HODL portfolio

You can also view my ‘Keep Calm + HODL on portfolio‘, which is more a virtual portfolio of all projects which I’m interested. Compiled Jan 2019 but evolving.

July 2019

Disclaimer: Not professional financial advice. Invest at your own risk. Always do your own research.