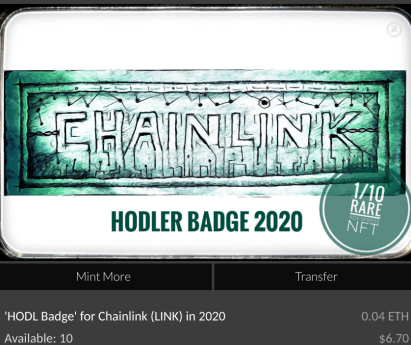

[Note: already a Chainlink hodler? Purchase an AdesPress tokenised collector’s art badge (2020) with Ethereum.]

What we find in Chainlink (LINK) is a project (literally) tied closely to Ethereum (and more blockchain networks to come). That is because Chainlink is one of the very few trying to bridge the gap between the real world of data and the blockchain level. This is achieved via its – decentralised – ‘oracles’ that will be incentivised by LINK cryptocurrency to provide trusted data which smart contracts can use.

Basically, a decentralised network with smart contracts doesn’t want to access external data that is centralised.

“The solution: a highly reliable decentralized oracle network.

Chainlink’s decentralized oracle network provides the same security guarantees as smart contracts themselves. By allowing multiple Chainlinks to evaluate the same data before it becomes a trigger, we eliminate any one point of failure, and maintain the overall value of a smart contract that is highly secure, reliable, and trustworthy.”

You can set up your own node and become an operator contributing data.

When, Where and How to Stake LINK?

If you’re interested in staking LINK to earn passive income then check out the site LinkPool.io. Here you don’t have to run a node but can contribute your LINK to a professionally-run, trusted node.

It uses MetaMask extension.

At time of writing this is still getting going, but worth exploring. LinkPool has its own dex for buy and sell Eth/LP etc. where LP is the LinkPool reward token. You’ll be able to stake without purchasing this token however.

The best thing is to read this guide, and stay tuned to progress.

LinkPool.io

Your LinkPool staking dashboard

Overall

The price of Chainlink (LINK) has seen a huge rise since (before) May 2019 as ‘big daddy’ Bitcoin began reminding the cryptocurrency ‘altcoin’ market who’s boss. Some of these altcoins vary widely in their focus and application, and may never resurface to all time highs, while many have held up quite well. These include the bigger networks like Ethereum and Eos, attempting to bring public decentralised blockchain to the mainstream, with programming languages and smart contracts for apps (or dapps) to prove their add-free, monetized properties.

The recent bull-run has witnessed LINK become a strong contender for one of these, where it achieved a boost from both a listing on major US exchange Coinbase, as well as interest from Google. For any project in this nascent space this is a golden combination of news, but it’s taken some time and some secretive work by Chainlink developers to get this far.

Price July 2019

Can the price maintain? Such a rapid rise may always see a pull-back at this stage, but with the prospect for professionally-run nodes to allow staking of LINK (including entities like Coinbase Custody) the future’s looking good. It may also integrate with more and more networks down this long and winding crypto-path towards better computing infrastructure, reliable smart contracts and faster value transfer.

Presently its price momentum has not suffered too badly and is in demand. Number 17 on Coinmarketcap.

Price January 2020

After July 2019 we did see expected decline in prices but recent bull-run has seen market on the up again and Chainlink still holding place at 17 on Coinmarketcap.

Development continues. Once staking via the LP token becomes available, then price should rise higher.

Resources

Website

Documents, what is, how to run a node etc.

Blog

Twitter updates

Youtube videos

LinkPool staking

Price: July 2019 = $3.43

Last minor update to page: Jan 2020 = $2.70

See current price on Livecoinwatch

Disclaimer: Not professional financial advice. Always do your own research (starting here at Ade’s Crypto Press:)

Chainlink forms part my long-HODL portfolio (check latest updates.)

View latest Ade’s Press Crypto Sign-up Offers! with free crypto in many cases.